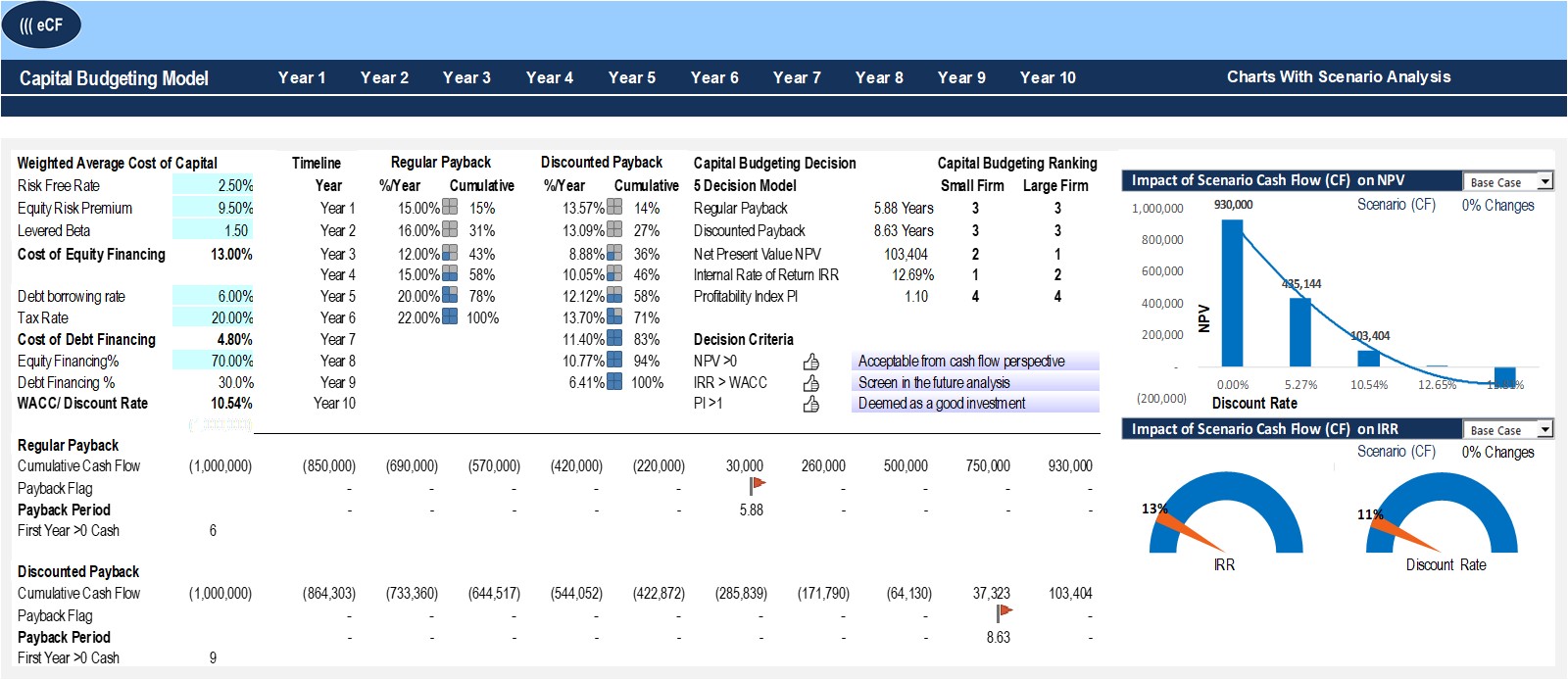

The advantage to using the NPV method over IRR using the example above is that NPV can handle multiple discount rates or varying cash flow directions. Each year’s cash flow can be discounted separately from the others, so the NPV method is more flexible when evaluating individual periods. The NPV method is inherently complex and requires assumptions at each stage such as the discount rate or the likelihood of receiving the cash payment.

Net present value method (NPV) LO5

When a firm is presented with a capital budgeting decision, one of its first tasks is to determine whether or not the project will prove to be profitable. The payback period (PB), internal rate of return (IRR), and net present value (NPV) methods are the most common approaches to project selection. The present value of each cash inflow and outflow is calculated in column D (column B x column C). The investment’s net present value is the sum of the present value for the cash inflows and outflows. Both models have a positive net present value, meaning they return over 10%.

The Difference Between a Capital Budget Screening Decision & Preference Budget

These funds can be swept to cover operational expenses, and management may have a target of what capital budget endeavors must contribute back to operations. Companies are often in a position where capital is limited and decisions are mutually exclusive. Management usually must make decisions on where to allocate resources, capital, and labor hours.

Capital Budgeting Decisions

A lump sum is a single receipt or cash payment in the future entered as a single year. A positive net present value means that the return on the investment is greater than the discount rate. Or that the investment yields a higher return than the discount rate used in the analysis. For example, if the net present value is positive and the discount rate is 12%, the project returns more than 12%. Although this tool does not provide the exact return, a positive value means that the return is more than 12%.

Payback Period

IRR can be solved manually through trial and error, though it is more efficient to leverage software programs to calculate IRR. It allows companies to conduct a thorough and systematic assessment of various investment opportunities, aiding in informed decision-making. Holly Rich is considering becoming an independent contractor for a national rideshare company as a second job. Her current car is older and not reliable enough to use for the business.

Why Do Businesses Need Capital Budgeting?

A zero net present value would mean the model returned precisely 10%. And a negative net present value means the models did not return 10%. It is important to note that a negative net present value does not always mean the project has a negative return. Instead, it indicates that the project does not return the discount rate used for the analysis. In this example, the net cash inflows from the Diamond LX model have a slightly higher net present value than the net cash inflows from the VIP Express model.

- These funds can be swept to cover operational expenses, and management may have a target of what capital budget endeavors must contribute back to operations.

- To evaluate alternatives, businesses will use the measurement methods to compare outcomes.

- When a company is considering an investment or project, it might use NPV to evaluate its future earnings today.

- Even the most experienced stakeholders can make bad decisions when there is no structured approach in place.

A short payback period is preferred, as it indicates that the project would “pay for itself” within a smaller time frame. The internal rate of return (IRR) method is similar to the simple rate of return with one significant difference. This method calculates the discounted rate of return of an investment over the useful life of the investment. The formula to calculate IRR includes the investment required for the project and the annual net cash inflow from the project.

For this reason, managers must be able to evaluate the alternatives and select the project that offers the most benefit to the organization. The ability to choose appropriate capital investments is an essential component non resident alien filed tax through turbotax of an organization’s long-term financial health and stability. A method used to evaluate the profitability of an investment by calculating the present value of expected cash flows minus initial investment.

In comparison, Project A is taking more time to generate any benefits for the entire business, and therefore project B should be selected over project A. Whether or not your IRR is good depends on your individual circumstances. Generally speaking, it will be good if it exceeds the “hurdle rate,” in other words, the cost of capital. Project managers can use DCF to help them decide which of the several competing projects are worth pursuing at the moment. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Without modification, IRR does not account for changing discount rates, so it’s just not adequate for longer-term projects with periods of varying risk or changes in return expectations. Unlike the IRR, a company’s net present value (NPV) is expressed in a dollar amount. It is the difference between a company’s present value of cash inflows and its present value of cash outflows over a specific period of time. The manager of Quick Print, Inc. wants to replace an outdated, large-format analog printer. She has narrowed the decision down to two digital models, the standard commercial model or the premium commercial model. Jen Labs is considering the purchase of a new lab machine to test blood samples for specific viruses.

For some companies, they want to track when the company breaks even (or has paid for itself). For others, they’re more interested in the timing of when a capital endeavor earns a certain amount of profit. Capital budgeting is often prepared for long-term endeavors, then reassessed as the project or undertaking is underway.